Interciencia

versión impresa ISSN 0378-1844

INCI v.34 n.10 Caracas oct. 2009

Studying the financial resources for agri-food industry and rural development: Description of human capital in credit unions through delphi analysis

Elies Seguí-Mas and Ricardo J. Server Izquierdo

Elies Seguí-Mas. Ph.D. in Business Administration, Universitat Politècnica de València (UPV), Spain. Professor, UPV, Spain. Address: Facultat dAdministració i Direcció dEmpreses, UPV. (Edifici 7J). Camí de Vera, s/n 46022 Valencia, Spain. e-mail: esegui@cegea.upv.es

Ricardo J. Server Izquierdo. Ph.D. in Agricultural Engineering, UPV, Spain. Professor, UPV, Spain. e-mail: rjserver@esp.upv.es

SUMMARY

Credit unions have been a key element for recent agri-food industry and rural development. However, whereas there are practical applications implemented in banks, there are rarely empirical studies about this legal form of banking system. Nowadays, the financial crisis is affecting the development of certain industries and territories. Credit unions, as singular financial organizations, have intangible elements with peculiar characteristics. These characteristics must be studied to manage their competitive advantages and provide management with relevant information for decision making. Through the Delphi analysis, this article will identify the singularities of human capital in these entities. The singularities of the credit union sector show that human resources are potentially more determined to adopt a strong corporate culture and invest more in training. On the other hand, main deficits of credit unions will be their aptitudes and lesser capacities, academic level or low investment in training.

Estudio de los recursos financieros para la industria agroalimentaria y el desarrollo rural: Caracterización del capital humano en las cooperativas de crédito mediante el análisis delphi

RESUMEN

Las cooperativas de crédito, como organizaciones singulares en nuestro sistema financiero, poseen unos intangibles de características particulares. Así, los valores de la cooperativa y de sus miembros, la estructuración del capital, las actitudes del personal o sus políticas de selección y de formación les confieren unas características específicas que merecen ser estudiadas para gestionar sus ventajas competitivas y ofrecer a su dirección información relevante para la toma de decisiones. Mediante el análisis Delphi, este trabajo trata de obtener identificar las singularidades del capital humano de estas entidades. Las singularidades del sector cooperativo de crédito muestran unos recursos humanos potencialmente más predispuestos a adoptar una fuerte cultura de empresa y a realizar una mayor inversión en formación. Por el otro lado, los principales déficits de las cooperativas de crédito vendrían derivados de sus aptitudes y de sus menores capacidades, dado su menor nivel académico y su menor inversión en formación.

Estudo dos recursos financeiros para a indústria agroalimentar e o desenvolvimento rural: Caracterização do capital humano nas cooperativas de crédito mediante a análise delphi

RESUMO

As cooperativas de crédito, como organizações singulares em nosso sistema financeiro, possuem intangíveis de características particulares. Assim, os valores da cooperativa e de seus membros, a estruturação do capital, as atitudes do pessoal ou suas políticas de seleção e de formação lhes conferem umas características específicas que merecem ser estudadas para gestionar suas vantagens competitivas e oferecer, à sua diretiva, informação relevante para a tomada de decisões. Mediante a análise Delphi, esta comunicação tenta obter e identificar as singularidades do capital humano destas entidades. As singularidades do setor cooperativo de crédito mostram recursos humanos potencialmente mais predispostos em adotar uma forte cultura da empresa e em realizar maior investimento em formação. Por outro lado, os principais déficits das cooperativas de crédito derivar-se-iam de suas aptidões e de suas menores capacidades, devido ao seu menor nível acadêmico e seu menor investimento em formação.

KEYWORDS / Agri-food Industry / Credit Unions / Human Capital / Intangible Assets / Intellectual Capital /

Received: 02/11/2009. Accepted: 10/12/2009.

Financial information represents the core of business information systems and, therefore, are critical for decision making and strategic planning of the organization. Accounting has recently suffered an evident loss of reliability and social relevance as a result of the appearance of a new economic paradigm. Several studies (Amat, 2002; Di Piazza and Eccles, 2002) demonstrate that a significant part of the value that markets attribute to corporations is not found in their balance sheets, even during stock markets crises.

Financial markets have identified the existence of a growing invisible balance sheet (Sveiby, 1997) in corporations. That invisible balance sheet is the consequence of differences between the real value of corporations (market value) and the resulting value of the application of generally accepted accounting criteria and principles (accounting value). Such a difference has been one of the main motivations for the development of methodologies to identify, measure and manage intangible and intellectual assets of an organization, especially those that accounting cannot collect.

The management of intangible assets of an organization is an outstanding competitive factor in the business literature of the last decade. Today, without doubt, knowledge has an essential role in the social and economic development since its emergence, process and transfer are shown to be sources of power and productivity (Castells, 1997). Thus, facing the current environment that is rapidly becoming uncertain and heterogeneous, the management of intellectual capital appears as one of the most evident responses to identify measure and manage critical resources of an organization.

Obviously, economic reality gives increasing weight to intangible assets within the chain of goods and services that makes the correct valuation of corporations and their assets more complex. This situation caused the arising of diverse models to identify and measure the intangible assets of an organization. Their objective is to optimize the management of intangible elements that make possible to develop the creation of value by the corporation. The general application of intangible assets management is still distant. Currently, there are some significant experiences in this field, in which the banking sector is in the vanguard.

This study will approach the accounting of human capital intangibles within a concrete business reality: credit unions. These corporations represent a singular case in the financial system and, despite their reduced relative weight in the sector, this type of financial institutions has been a key element for recent socio-economic development of extensive regions, its role being evident in sectors such as agri-food industry. However, whereas there are practical applications implemented in banks and savings banks, there are rarely empirical studies about this legal form of banking system.

As a result, this study will approach the description of human capital in credit unions to provide relevant information for decision making to this type of corporations in a highly complex and increasingly competitive environment such as the banking industry. The study is carried out with the qualitative Delphi methodology, which is appropriate for this type of analysis where there is a clear lack of information about the analyzed phenomenon (Sanchez et al., 1999).

This study is structured in six parts. The first two establish, in a concise manner, the conceptual framework of human and intellectual capital, and define the role of credit unions within the banking system. In the next two parts, a case study is presented, distinguishing among previous aspects (methodologies, sources, general approach to the case, etc.) and the measure of variables and indicators of human capital. Finally, implications for the optimization of human capital of the analyzed corporation are established, and conclusions from the case study are presented.

On this matter, it is compulsory to formulate the following two research questions: Does the legal form influence the configuration of human capital in the organization? and Which are the peculiar characteristics of human capital in credit unions? What differentiates them from banks?

Human Capital

Philosophers like Aristotle and classical economists such as Adam Smith or Alfred Marshall pointed out the importance of people in any human corporation. Nevertheless, it is just in the last years when the great relevance of people has been noticed and new concepts like human capital have emerged.

The term human capital was coined for the first time by Nobel prize winner in economics Theodore W. Shultz in 1961. Since then, business literature has included different and heterogeneous definitions under this concept. However, beyond the number of existing definitions, there is certain consensus to determine human capital as the group of skills, experiences and knowledge of personnel in an organization.

According to researchers on this subject, in the perception of human capital value, there are three main phases (Davenport, 2000; Ortega, 2004):

Human capital as a cost. Persons are an important part of its exploitation expenses. Although they are essential to generate income in the financial year, the perception of human capital value is centered in the implied cost (and its control).

Human capital as an asset. "Persons are the main asset of the organization" represents a higher level concept of human capital. Hence, persons are seen as resources from which future benefits are expected and are under the corporations control.

Human capital as investment. In the last years, the characteristics of the job market (under unemployment, more rotation of employees, etc.) have involved the conceptualization of human capital as something more than an asset. In this case, given the more power in negotiation of personnel, instead of investing money in the corporation, it does it with time, knowledge, skills and experience.

In conclusion, regardless of their perception, many researchers consider human capital as one of the main factors that explain productivity growth in the long term in an organization (Saá and Ortega, 2002). Many studies have tried to compare human capital with business results (Hall, 1992), and two traditional approaches have been identified (Danvila, 2006): i. Through variable flows which are representative of the corporations investment in training for -later- compare them with the obtained results. ii. Through qualitative studies of empirical character based on questionnaires.

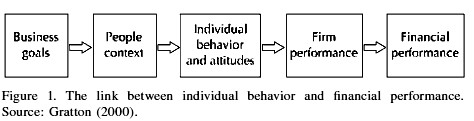

In addition, as Gratton (2000) states, different European and American studies have determined the influence of employees behavior on financial results of corporations according to the causal model depicted in Figure 1.

To define and disintegrate the variables on this point, the equation of human capital (Figure 2) of Davenport (2000) is of interest. It defines human capital as the sum of capacity and behavior multiplied by effort and time.

Furthermore, to homogenize the exposed concepts, it will be useful to define the integral elements of the human capital equation:

Ability implies expertise in a number of activities or forms of work. It has three main elements: a) skill is the familiarity with methods and own means of a determined task; b) knowledge represents the intellectual context in which a worker performs and, therefore, the workers mastery to fulfill a job position; and c) talent is the innate capability of an individual to perform a specific task.

Behavior reflects, since it may be observed, our values, beliefs and reactions in the presence of the reality that surrounds us. It contributes to the performance of tasks inherent to ones activity and responds to the individuals experience and situational stimulus in certain periods of time.

Efforts represent the conscious application of physical and mental resources for a concrete goal. It is related to labor ethics, it gives value to capabilities and behavior of individuals (it would not be useful to have capabilities without efforts for the achievement of determined results).

Time is the chronological element and it has been, usually, excluded from human capital models since it cannot be found in the persons mind. Nevertheless, time is a fundamental personal resource which is under the individuals control.

On the other hand, and as Itami and Roehl (1987) indicated, generation of human capital may be obtained and accumulated basically through two paths: training, providing HHRR with new knowledge and skills, and knowledge, received through experience.

Qualitative Research: Delphi Analysis

Measuring in social research is more complicated than in natural sciences, since there are more imprecision problems and measuring variations are much more unpredictable in human subjects. As a function of the type of research envisaged, the use of quantitative or qualitative techniques may result complementary but not exclusive. In fact, it is possible to generate a number of synergies. Consequently, the results are mutually reinforced and allow to study in depth until a point that any of the mentioned methodologies, separately, could reach.

Delphi method

Linstone and Turoff (1975) defined the Delphi technique as a "method of structuring a process of group communication that is efficient for allowing group of individuals as a whole to deal with a complex problem". This technique tries to be a systematic and recurrent method addressed to obtain opinions of a group of experts (and, if possible, consensus as well).

Delphi analysis may be used for two fundamental objectives (Dalkey and Rourke, 1971): i. Predictable goals to get information about future scenarios; this is the most known utility and it characterizes the Delphi method as a predictable technique in conditions of uncertainty (Fildes et al., 1978). ii. Obtaining opinions when requiring information about specific topics on which there is no previous information; this application is especially relevant when there is not historic data because it allows collecting a broad typology of interrelated variables (Gupta y Clarke, 1996).

On the other hand, distinctive characteristics of this subjective group technique are that participants remain anonymous during the process (preventing groupthink), controlled feedback to participants enables free of noise transmission (that is to say, without irrelevant, redundant and even incorrect information), and there is a statistical group response (to take into account all individual opinions for the final group result).

The purpose of the Delphi technique is to obtain a reliable group opinion of experts (Landeta, 1999). The recurrent process ends when it is perceived that the estimations remain stable; that is to say, when the median hardly oscillates and the interquartile range stops becoming narrower (after at least two rounds). From this point, the last steps are to get the group response in the last round and prepare the corresponding report.

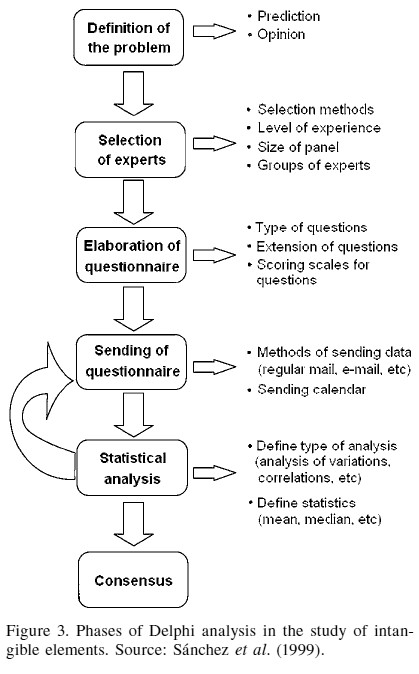

The concrete application of the Delphi analysis in the intangibles field has been approached by Sanchez et al. (1999). Its goal was to generate some shared guidelines for the measurement and diffusion of information about intangible elements illustrating the characteristics to adapt the method to this field. A graphic chart about the development of phases of Delphi analysis specifically in the study of intangible elements is depicted in Figure 3.

Human Capital in Credit Unions. Preliminary Concepts

Given the lack of studies on human capital in credit unions, the application of the Delphi methodology is useful in an exploratory study. For this type of studies, most of social researchers recommend the use of qualitative methodologies (Sánchez et al., 1999; Corbetta, 2003). The goal of the present study is to determine if the legal (and philosophical) nature of credit unions influences the composition of their human capital. Nevertheless, the application of the Delphi method specially seeks to identify the singularities of human capital of credit unions in relation to banks and savings banks, on a comparative basis.

The Delphi method gathered the opinion of 25 participants from academia, professional (basically credit unions CEOs) and institutional experts. Electronic mail was used to facilitate the distribution of the different questionnaires to participating experts. This tool is especially useful in this type of studies since it facilitates the filling out of questionnaires and speeds up sending and receiving information.

Composition of the group of experts

Respondents with three profiles were contacted to form the panel of experts: credit unions CEOs, academic experts in related study areas and technicians of private and public corporations that provide services in the industry. Consultants that advise or audit diverse credit unions were also invited. In total, 71 experts were contacted, giving priority to a number of credit unions CEOs for their predictable lower response rate.

Regarding the typologies of experts, all belong to the category of "specialists". No facilitators were included because they were irrelevant for this analysis.

The first round had 25 experts, 22 of them remaining at the second round. This number is not only statistically significant but also minimizes errors in the qualitative study, as a larger number of participants would have hardly reduced errors.

The analysis of results first determined the number of valid responses for each question; the 25 participants in the study replied to all or most of the questionnaire. Some mistakes were identified and the questions were removed in subsequent statistics.

Human Capital in Credit Unions. Results

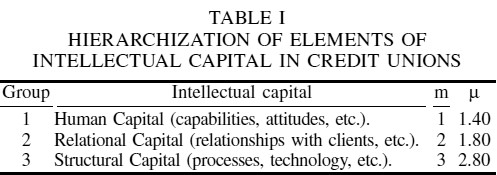

The results from opinions regarding the importance of blocks of intellectual capital after the second round generated a unanimous response: human capital is the most relevant of the three intellectual capital elements in a credit union (Table I). This study proves that convergence of opinions was minimal since the ones referred to human and structural capital did not change at all. Only opinions related to relational capital changed, converging.

Analysis of the process

In the first part of the study, the main weaknesses and strengths of human capital in credit unions were pointed out. Most experts (24) gave at least one contribution. The results of these open questions are shown later. The second part has 13 evaluative items with a scale from 0 to 10. The 22 participating experts in the second round evaluated each of the 13 questions.

Finally, the last part posed four questions to compare the human capital of credit unions with that of the rest of firms in the credit sector. Once more, each participating expert in the second round replied to all questions.

Analysis of results

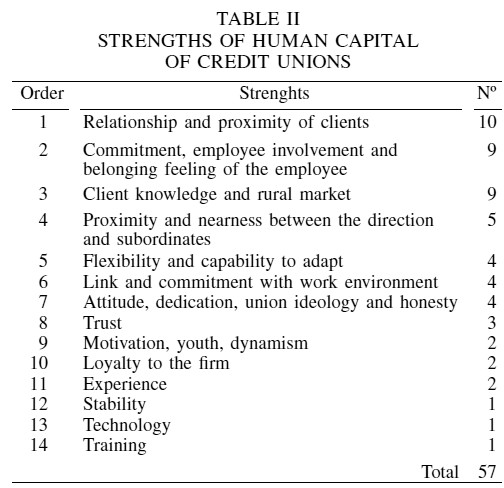

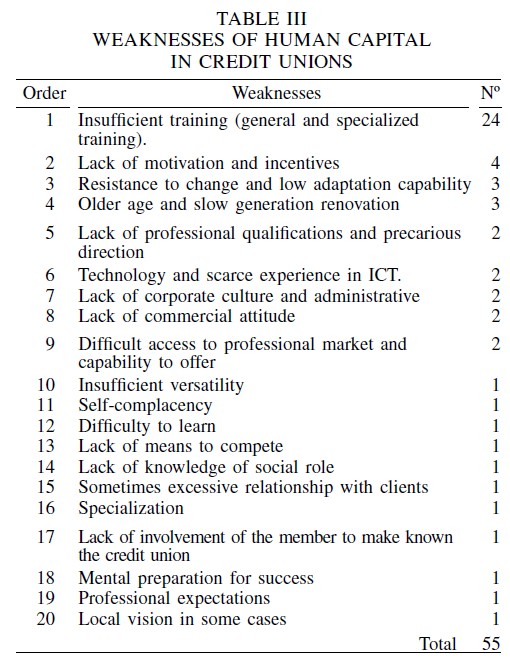

Tables II and III summarize the contributions of the two open questions of the second round of study, concerning strengths and weaknesses of human capital in credit unions. It can be observed that most experts consider that knowledge and relationship between employees and clients, and also with the traditional market of credit unions, are the main strengths of their human capital. Furthermore, feelings of commitment and belonging of employees are strong points in this type of credit firms.

Regarding weaknesses, insufficient training of employees stands out; considering general training as well as specialized training on financial products, union matters, marketing, etc. Other weaknesses indicated by experts less relevant; lack of motivation, low adaptation capability to change, or older age average of employees stand out.

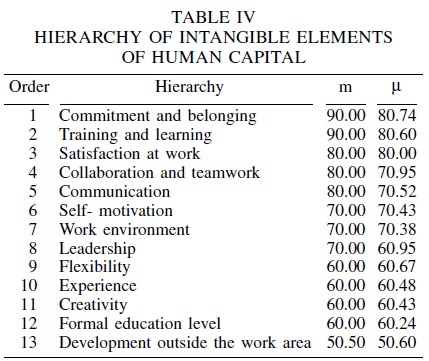

On the other hand, with regard to valuation of variables of human capital of unions, the results of statistical processing of the data, after the second round, reached an absolute consensus in the response of the group, which overcomes the three opinions that were out of consensus in the first round. From the valuations (Table IV), it is possible to determine a new hierarchy of variables of human capital in function of their importance in credit unions.

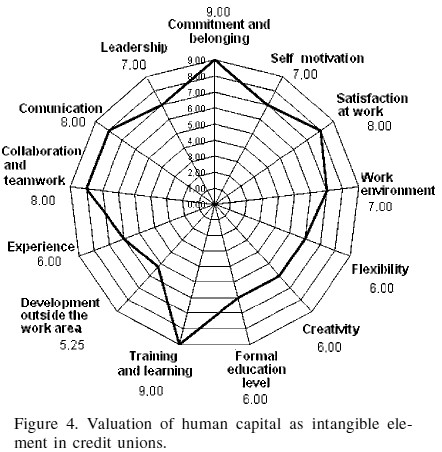

Figure 4 summarizes graphically, within a radial diagram, the previous results. It attempts to prove the characteristic profile of human intangible value in credit unions. It can be observed that feelings of commitment and belonging, together with training and learning, are the most valued intangible elements of human capital in credit unions. In this sense, elements such as satisfaction at work, collaboration and teamwork, and communication, are also relevant. In the negative side, small relative importance of intangible elements such as flexibility, experience, creativity, education level, or particularly development outside the work area stand out.

It is at least strange to find a high valuation of training and learning when, at the same time, it is known that training of personnel is the weakest element of human capital in credit unions. There is a sign that most of firms in the industry have not applied policies to attract and/or train personnel to correct this relevant deficit, or they have recently implemented such policies.

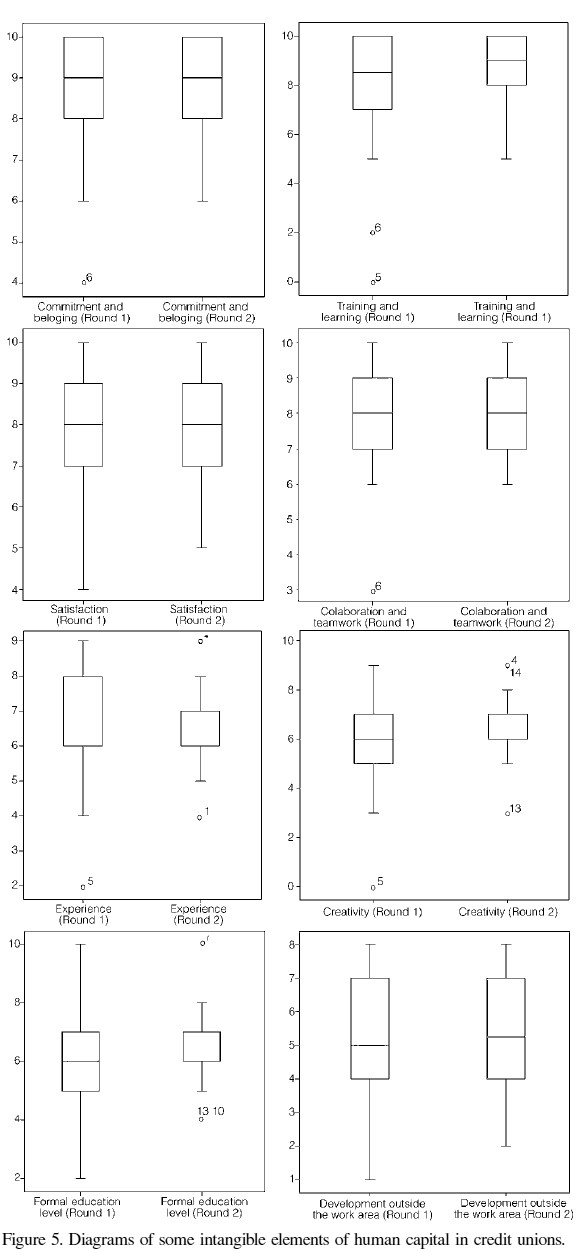

Figure 5 illustrates the convergence produced in the statistical opinion of the group with respect to the 8 intangible elements of human capital evaluated. A higher position in the diagram box logically indicates that a given intangible element has more relative importance within the credit union sector.

The results of the second sample show how, in 12 out of the 13 intangible elements evaluated, significant convergence of experts opinion was produced, increasing the level of group consensus.

The hierarchy established for the elements of human capital changed slightly after the second round. Although there are few changes among elements with an equivalent median, self-motivation increases at expense of work environment, and formal education level decreases to the twelfth place, while flexibility and creativity improve their positions. However, we consider that these are changes that do not have too much importance in the intermediate and low zone of the chart.

The significant higher evaluation of the two main elements, commitment and training, in both median and mean terms, is important. In an analogous way, the least valued element (development outside the work area) improves.

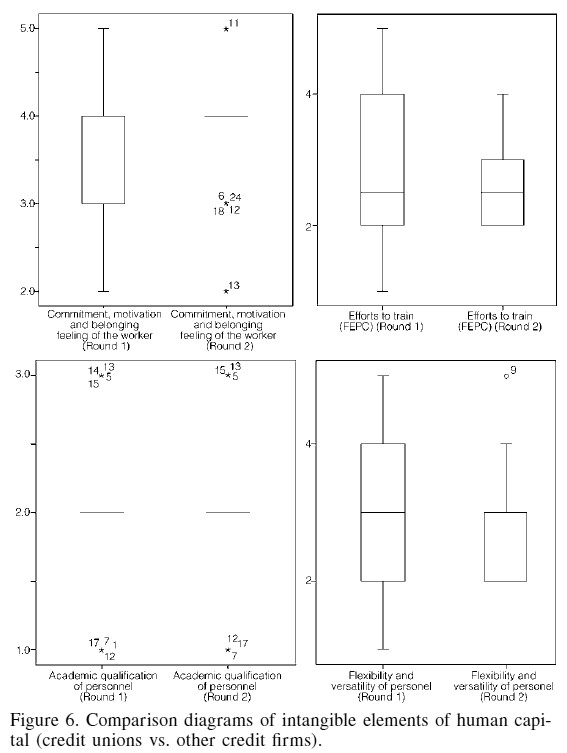

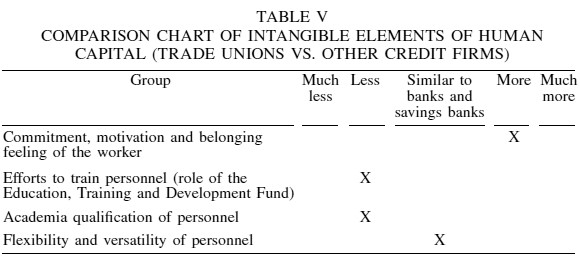

Figure 6 presents the results of the comparative analysis between the main group of intangible elements of human capital in credit unions and other banking firms such as banks and savings banks. After the second round of the study, when comparing human capital of the two groups, consensus emerges regarding the statistical response of the experts group. In addition, there is a unanimous opinion stating that academic qualification of personnel in credit unions is lower than in personnel of banks and savings banks. On the contrary, the unanimity of the group in evaluating the feeling of commitment and belonging of workers in credit unions stands out with a higher value.

During this second round, the opinion of the group changed regarding the efforts to train personnel in credit unions. Whereas at the end of the first round there was consensus considering that the efforts in credit unions were similar to those in banks and savings banks, after the second round the group considered that in the former they were lower. In both rounds the most frequent response considered these efforts to be low; in addition, there were few lower values for the answer in the second round, which seemed to have affected the group opinion on this point.

The fact that training was evaluated as one of the main intangible elements of human capital also stands out and. in contrast, there was consensus that the efforts to train are better than those in banks and savings banks (despite the existence of the Education, Training and Development Fund).

Table V shows the convergence level of experts opinion along the two rounds regarding the previously compared questions. It can be verified that there was significant convergence in all the studied elements. The unanimous consensus reached with respect to the best evaluation given to commitment, motivation and feeling of belonging in credit unions stands out particularly. Furthermore, there was also unanimity to evaluate the academic qualification of personnel as the "worst".

Conclusions

First, it should be pointed out that, as in other studies, human capital is according to the experts the main group of intangible elements of the intellectual capital in credit unions. This is why, given its relevance, focusing the study on this topic has been accurate.

Second, it is necessary to insist that the credit union industry includes a group of very heterogeneous realities, where firms which are exclusively local interact with others that are much bigger, and therefore, it is complicated to reach conclusions and make valid comparisons for each of the existing realities.

Looking at the results of the qualitative methodologies that were developed in this study, the first specific conclusion is obvious: the legal form significantly determines the structure of the human capital in credit unions. Consequently, in a strong competitive environment such as the banking industry, the future strategy of credit unions should reinforce competitive advantages of their human capital and size the opportunities of each scenario.

More specifically, human capital of credit unions stands out especially due to the relevance of values and attitudes. Commitment, feeling of belonging and personnel motivation are not only the most valued elements in the industry, but their levels are also above those of other credit firms, and constitute a clear of strength or competitive advantage.

Territorial roots, proximity between directors and subordinates, and union ideology or loyalty to the firm are factors that could justify this strength, which heads of credit unions should continue to promote. The fact that credit unions belong to the so-called social economy provides them with an ideology that is fundamentally fed by values and attitudes. Furthermore, variables of human capital in credit unions are linked to values and attitudes which, in general, have been the most valued in the hierarchy of intangible elements established by the experts, a fact that remarks their relative importance. Elements such as training and learning, satisfaction, collaboration and communication are the most relevant in this type of firms.

Developments outside the work area, flexibility, experience, creativity or formal education level are intangible elements which have rarely stood out in credit unions.

On the contrary, intangible elements of human capital linked to aptitudes of the personnel represent a clear weakness of credit unions. In this sense, according to the experts, the fundamental weakness of human capital in credit unions is conditioned by the insufficient training and qualification of their employees. Also, the consensus reached by the group of experts about the efforts to train and the academic qualification of the personnel in credit unions reveals an obvious disadvantage in comparison to banks and savings banks.

In addition, except training (which is a very valued intangible element), the other variables related to aptitude (formal education, experience and personal development) are given very little value in the hierarchy. Thus, this weakness identified in credit unions could be considered a priori as relative, given its low relevance.

Once more, the paradox of the great value given to training when at the same time it represents the main weakness of human capital should be pointed out and, also, that the efforts to train personnel are lower than those made by banks and savings banks, despite of the existence of the Education, Training and Development Fund.

In conclusion, credit unions should redefine their policies to attract human resources. Explicit policies have to be established to include profiles with better level of formal education and more training than the current ones. In the same manner, policies for training and professional development must be carried out to overcome the lack of professional qualification of human capital. Thus, the implementation of the Education, Training and Development Fund should involve a competitive differentiated advantage of credit unions. Its fundamental role should be to reach levels of personnel qualification comparable to the levels in other credit firms.

Third, it is convenient to mention the intangible elements of human capital in credit unions, related to capabilities of personnel. Logically, as a consequence of lower levels of education and due to lower efforts to train, learning in credit unions is worse than the obtained by savings banks and banks. However, it is accurate to make the same objection made in the previous section, related to the heterogeneity of the industry.

The experts group considered as important the variables collaboration, teamwork and communication, although it was unfeasible to state their situation in relation to other credit firms. On the contrary, leadership is a secondary variable regarding capabilities of personnel in credit unions.

The first general recommendation stemming from this study is to strengthen teamwork to increase the capabilities stock of the firm. Formalization of job networks within and outside the corporations (like credit union groups) seems to be an excellent path to seek synergies and scale economies.

Another intangible element to be improved is training. Taking into account the possibilities that the information and communication technologies (ICT) currently offer, it is of interest to include virtual training (e-learning) in the training offer of credit unions, or in the services offered by autonomous federations. More flexibility in the offer, with access to contents in an asynchronous form and from any part of the planet, and more cost savings could be achieved, allowing a larger number and a broader range of training actions.

Given the obvious weakness that implies having personnel with less capabilities than competitors, in terms of formal education and training, each credit union needs to establish personnel recruitment and selection policies addressed to increase the stock of aptitudes of their personnel, for example, selecting only persons with a high study level.

Acknowledgements

This study was funded by the Spanish R&D Plan of the Ministry of Science and Technology (DER2008-03475).

REFERENCES

1. Amat O (2002) Reflexiones y propuestas sobre los problemas de la información contable. Economista 83: 94-103. [ Links ]

2. Castells M (1997) La Era de la Información. Economía, Sociedad y Cultura. Alianza. Madrid, Spain. 411-415 pp. [ Links ]

3. Corbetta P (2003) Metodología y Técnicas de Investigación Social. McGraw-Hill. Madrid, Spain. 448 pp. [ Links ]

4. Dalkey NC, Rourke DL (1971) Experimental Assesement of Delphi Procedures with Group Value Judgments. Rand Corporation, R612-ARPA. En Sánchez MP, Chaminade C, Escobar CG (1999) En busca de una teoría sobre la medición y gestión de los intangibles en la empresa: Una aproximación metodológica. Economiaz 45. [ Links ]

5. Danvila del Valle I (2004) La Generación de Capital Humano a Través de la Formación: Un Análisis de su Efecto sobre los Resultados Empresariales. Thesis. Universidad Complutense de Madrid. Spain. 24-25 pp. [ Links ]

6. Davenport TO (2000) Capital Humano: Creando Ventajas Competitivas a Través de las Personas. Gestión 2000. Barcelona, España. 21-44 pp. [ Links ]

7. Di Piazza SA, Eccles RG (2002) Building Public Trust-The Future of Corporate Reporting. Wiley. New York, USA. 33-54 pp. [ Links ]

8. Fildes R, Jalland M, Wood D (1978) Forecasting in Conditions of Uncertainty. Long Range Plann. 2: 29-38. En Sánchez MP, Chaminade C, Escobar CG (1999) En busca de una teoría sobre la medición y gestión de los intangibles en la empresa: Una aproximación metodológica. Economiaz 45. [ Links ]

9. Gratton L (2000) Living Strategy: Putting People at the Heart of Corporate Purpose. Financial Times Press. New Jersey, USA. 9-11 pp. [ Links ]

10. Gupta U, Clarke R (1996) Theory and applications of the Delphi technique: A bibliography (1975-1994). Technol. Forecast. Soc. Change 53: 185-211. En Sánchez MP, Chaminade C, Escobar CG (1999) En busca de una teoría sobre la medición y gestión de los intangibles en la empresa: Una aproximación metodológica. Economiaz 45. [ Links ]

11. Hall R (1992) The strategic analysis of intangibles resources. Strat. Manag. J. 13: 135-144. In Cañibano Calvo L (2002) Directrices para la Gestión y Difusión de Información sobre Intangibles. Fundación Airtel Móvil. Madrid, España. [ Links ]

12. Itami H, Roehl TW (1987) Mobilizing Invisible Assets. Harvard University Press. Cambridge, MA, USA. pp. 23-25. [ Links ]

13. Landeta J (1999) El Método Delphi: Una Técnica de Prevision para la Incertidumbre. Ariel. Barcelona, Spain. 31-46 pp. [ Links ]

14. Linstone HA, Turoff M (1975) The Delphi Method: Techniques and Applications. Addison-Wesley. In Landeta J (1999) El Método Delphi: Una Técnica de Prevision para la Incertidumbre. Ariel. Barcelona, Spain. 31-46 pp. [ Links ]

15. Ortega R (2001) El Índice de Capital Humano: Una Herramienta para Fidelizar el Capital Intelectual. Harvard Deusto Business Review. Madrid, Spain. 86-93 pp. [ Links ]

16. Saá Pérez P, Ortega Lapiedra R (2002) La formación. In Bonache J, Cabrera A (Eds.) Dirección Estratégica de Personas. Prentice-Hall. Madrid, Spain. 121-139 pp. [ Links ]

17. Sánchez MP, Chaminade C, Escobar CG (1999) En busca de una teoría sobre la medición y gestión de los intangibles en la empresa: Una aproximación metodológica. Economiaz 45. [ Links ]

18. Sveiby KE (1997) The New Organizational Wealth: Managing & Measuring Knowledge-Based Assets. Berrett-Koehler. San Francisco, CA, USA. 11-18 pp. [ Links ]

uBio

uBio